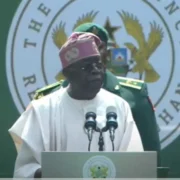

ABUJA — President Bola Tinubu has reaffirmed that Nigeria’s new tax laws, including those effective from June 26, 2025, and remaining acts set to commence on January 1, 2026, will be fully implemented as scheduled.

The announcement comes amid renewed calls from the Peoples Democratic Party (PDP) for a suspension of the commencement date, citing alleged discrepancies between the harmonised version of the tax law passed by the National Assembly and the version later gazetted, which, according to the party, have sparked public concern nationwide.

In a statement, President Tinubu acknowledged the concerns but insisted that no substantial issue warrants delaying the reform process. He described the reforms as a “once-in-a-generation opportunity” to build a fair, competitive, and robust fiscal foundation for Nigeria.

“The tax laws are not designed to raise taxes, but rather to support a structural reset, drive harmonisation, and protect dignity while strengthening the social contract,” Tinubu said. He urged all stakeholders to back the implementation phase, which he described as being firmly in the delivery stage.

The PDP, however, argued that the government is prioritising financial considerations over citizens’ welfare. In a statement by its National Publicity Secretary, Ini Ememobong, the party criticised alleged illegal insertions into the law and demanded a thorough investigation. “A mere suspicion that unapproved sections have been smuggled into a law affecting all Nigerians is sufficient reason to suspend its commencement,” the PDP said.

Meanwhile, the Nigeria Employers’ Consultative Association (NECA) has backed the January 1 implementation date, warning that any delay would amount to “a crime against Nigeria.” NECA Director-General Adewale-Smatt Oyerinde emphasised that while the law may not be perfect, it contains provisions for future amendments and urged stakeholders to remain engaged throughout the process.

Highlighting potential economic benefits, Oyerinde said the reforms could start impacting Nigerians and businesses meaningfully in 2026, provided the government sustains stable, supportive policies for the private sector.

Comments