Nigeria is set to usher in a new era of revenue administration as the Federal Inland Revenue Service (FIRS) formally transitions into the Nigeria Revenue Service (NRS) from January 2026.

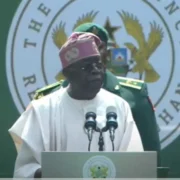

The change follows the signing into law of far-reaching tax and revenue reforms by President Bola Ahmed Tinubu earlier this year, marking what officials describe as a fundamental restructuring of how public revenue is collected, managed, and accounted for in the country.

Speaking on the development, Arabinrin Aderonke Atoyebi, Technical Assistant to the Executive Chairman of FIRS, Dr. Zacch Adedeji, said the transition represents far more than a change of name, stressing that it responds to long-standing public demands for transparency, accountability, and improved economic governance.

DAILY POST reports that the transition was approved through four major pieces of legislation signed into law on June 26, 2025. These include the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Act, 2025, and the Joint Revenue Board (Establishment) Bill.

Together, the laws replace the former FIRS Act and provide the legal foundation for the new NRS, significantly expanding the scope of federal revenue administration.

According to Atoyebi, the NRS will now be responsible for all federal government revenue, covering both tax and non-tax sources. She explained that this expanded mandate is designed to strengthen coordination among government agencies and enhance oversight of funds flowing into the Federation Account.

“This is not about giving the agency a new name,” she said. “It is a change in how the country manages revenue.”

Under the new framework, the NRS will integrate its systems with other revenue-generating agencies, enabling the government to track what is collected, how it is collected, and where it goes. Atoyebi described this as a critical step toward the transparent Nigeria many citizens have long advocated.

She noted that taxpayers and businesses are expected to benefit from a more streamlined and efficient process, with simplified registration, filing, and payment systems that reduce the need for physical visits to multiple offices.

“Registration, filing, and payment will be straight to the point,” she said, adding that the reforms would improve service delivery and help businesses plan more effectively.

Atoyebi also highlighted provisions within the new laws aimed at strengthening data protection and confidentiality, addressing concerns frequently raised by taxpayers.

“Confidentiality is clearly protected,” she said, assuring citizens that their personal and financial information would remain secure.

As Nigeria approaches 2026, the shift from FIRS to NRS is widely viewed as laying the groundwork for a revenue system anchored on trust, accountability, and efficiency.

“2026 is no longer just another year,” Atoyebi said. “It marks the beginning of a revenue era built on trust, accountability, and progress for every Nigerian.”

Comments