The Federal Inland Revenue Service (FIRS) has debunked claims suggesting that Xpress Payments was handpicked to manage the nation’s revenue collection, describing the allegations as misleading and an attempt to politicise a purely administrative process.

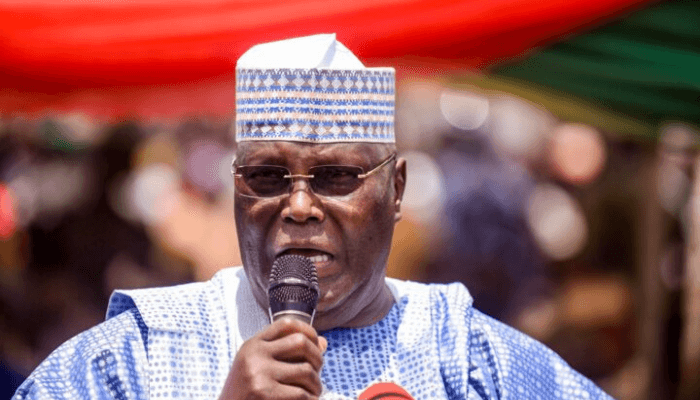

In a statement signed by Arabinrin Aderonke Atoyebi, Technical Assistant on Broadcast Media to the Executive Chairman of FIRS, the agency responded to comments by former Vice President Atiku Abubakar, clarifying that it does not operate any exclusive or centralised payment gateway for tax collection.

According to the service, no private organisation has been granted monopoly rights over government revenues. Instead, the FIRS said it runs a broad, multi-channel Payment Solution Service Provider (PSSP) system featuring long-established platforms including Quickteller, Remita, Etranzact, Flutterwave and XpressPay.

The agency explained that this competitive ecosystem was deliberately designed to make tax payment simpler, more convenient and more accessible for taxpayers across the country.

It further stressed that PSSPs are not collection agents and do not earn commissions, percentages or processing fees from government revenues. All funds paid through these channels, the statement noted, go directly into the Federation Account, ensuring transparency and preventing diversion.

The FIRS added that the multi-channel approach enhances efficiency, strengthens reporting and monitoring, and promotes innovation and job creation within Nigeria’s financial technology industry. Onboarding new PSSPs, it said, follows a transparent, verifiable process that guarantees fairness to all operators.

The agency also pointed to ongoing national tax reforms led by the Presidential Committee on Fiscal Policy and Tax Reforms, describing them as fundamental to modernising the country’s economy. These reforms, it emphasised, should not be dragged into political controversy.

FIRS urged political figures and commentators to refrain from misrepresenting routine administrative procedures, warning that Nigeria’s tax administration system is too crucial to be clouded by misinformation or unnecessary disputes.

Comments