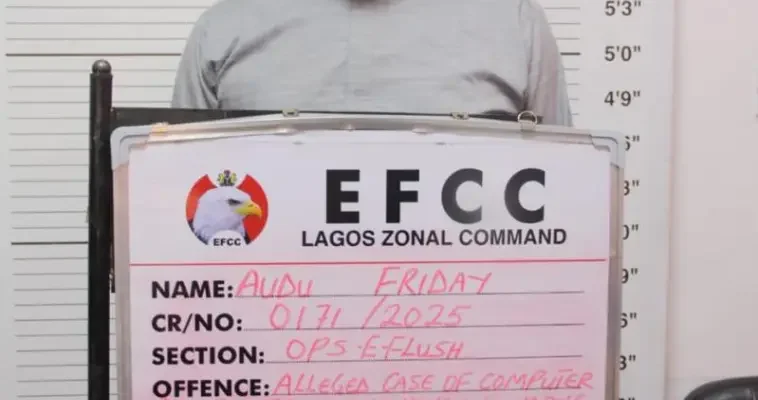

A Union Bank compliance officer, Mr. Chidubem Ogbura , on Monday testified before Justice Daniel Osiagor of the Federal High Court in Lagos in the ongoing trial of Friday Audu and three others, accused of masterminding a 792-member syndicate involved in cryptocurrency investment and romance fraud amounting to N3.4 billion.

Chidubem, appearing as the first prosecution witness, told the court that Audu is a signatory to the Union Bank account of Genting International Company Ltd, one of the companies allegedly used to launder proceeds from the syndicate’s criminal activities.

Led in evidence by EFCC counsel Bilkisu Buhari-Bala, Chidubem explained that his role involved responding to regulatory requests, including a December 16, 2024, inquiry from the EFCC regarding Genting International Ltd.

He tendered the account opening documents and statements, which the court admitted into evidence without objection.

Under cross-examination by Clement Onwuenwunor (SAN), counsel to the second defendant, the witness confirmed that Friday Audu and Bafale Yakubu were the account’s signatories.

Chidubem also stated that he observed the names of the second and third defendants in the account statements.

Counsel to the third defendant, Adeniyi Joshua, asked if the third defendant was a signatory or director of the company, to which the witness replied “no.”

He also confirmed that the account was not opened for the purpose of “gaining business,” as indicated in the bank’s KYC documentation.

Having completed his testimony, the witness was discharged.

Following this, counsel to the first defendant, Emeka Ukpoko (SAN), requested that the Nigerian Correctional Service provide a medical report on the second defendant due to unspecified health concerns.

Justice Osiagor adjourned the case until July 4, 2025, for continuation of trial, with more EFCC witnesses expected.

The EFCC had arraigned Friday Audu, Huang Haoyu, An Hongxu, and Genting International Ltd on a 12-count charge bordering on cybercrime, money laundering, and illegal foreign exchange transactions. They pleaded not guilty.

The defendants are accused of working with one Dualiang Pan (now at large) to operate a 792-member cryptocurrency and romance fraud syndicate that targeted victims through false identities.

They allegedly procured Nigerian youths to impersonate foreign nationals, and facilitated the retention of $1.2 million and $1.3 million in crypto wallets held by Chukwuemeka Okeke, Alhassan Garba, and Ifesinachi Jacobs—funds said to be proceeds of fraud.

According to the EFCC, the defendants also retained N3.4 billion in Genting Ltd’s Union Bank account and transferred N106 million and N913 million to Dualiang Pan’s UBA account. They are further accused of conducting illegal forex transactions totaling over N2 billion without using the official Central Bank of Nigeria (CBN) platform.

The alleged offences violate Section 29(2) of the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act, 2004; Sections 18 and 27 of the Cybercrime (Prohibition, Prevention, etc.) Act, 2015; and Sections 18(2)(d) and 21(c) of the Money Laundering (Prevention and Prohibition) Act, 2021.

Comments