Some officials of the Central Bank of Nigeria (CBN) yesterday told members of the Senate Ad-hoc Committee all they knew about the N30 trillion overdraft to the Federal Government .

They were also grilled on the N1.1 trillion Anchor Borrowers’ fund given to rice farmers by the apex bank.

Following a motion and debate on some of the activities of the CBN under former Governor Godwin Emefiele, the Senate raised a 19-member panel to investigate the huge overdraft to the Federal Government (also refers to as Ways and Means).

The panel was given six weeks to submit its report.

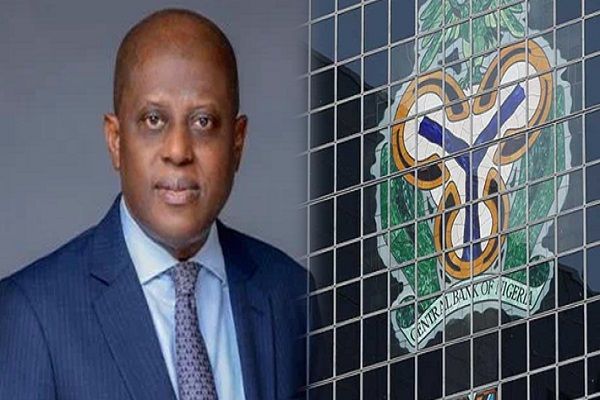

Those who appeared before the panel chaired by Kogi East Senator Isah Jibrin, were led by CBN’s Deputy Governor (Corporate Services), Bala Bello.

Jibrin told reporters after the Committee met with the apex bank officials at the National Assembly in Abuja, that the loans must be recovered in full.

Bello made presentation on the N30 trillion Ways and Means and Anchor Borrowers fund on behalf of the apex bank to the Jibrin-led committee.

According to the senator, the committee was able to extract useful information from the CBN, which will guide their next discussion.

He said the panel had issues with approvals in areas where it was discovered that the CBN governor “unilaterally gave approvals”, which committee considered as abnormal.

He said: “The committee could not get immediate explanation for that and therefore gave 24 hours to provide the necessary explanation.

“We believe that every approval must be given by the Committee of Governors (COG) i.e. the governor and his deputies. That is the standard rule. Where the governor alone unilaterally gives approvals that call for questioning, I think they will provide answers for us very soon.”

However, the N1.1 trillion Anchor Borrowers’ funds had an impressive repayment rate of up to 70 per cent performance and the rest 30 per cent of the N358 billion are loans given to low income farmers with very high risk.

Jibrin identified the risk as the inability of the low income farmers to perform to expectation in terms of “equipment, technical know how to manage those farms effectively. That is where we are likely to have problems of loan default”.

He said the committee had advised that the credit risks lie with the commercial banks that processed the loans, adding that the banks should in turn go after those borrowers to recover their monies.

Comments